Private Capital’s Role in the Impact Investment Ecosystem

It’s a great honour to be a judge once more for the BVCA’s Excellence in Impact awards.

Last year, I hugely appreciated the chance to see the impact creativity, skills and rigor of the private equity and venture capital community up close. I had the privilege of observing firsthand how the best in private capital – GP, LP and investee - are contributing to solutions for a better world.

The world’s social and environmental challenges require a different economy: financial services can bring its innovation and skills to capitalise businesses that respond to and meet the great challenges of our time, including the just transition, left behind communities and the health and wellbeing of our society, to name but three.

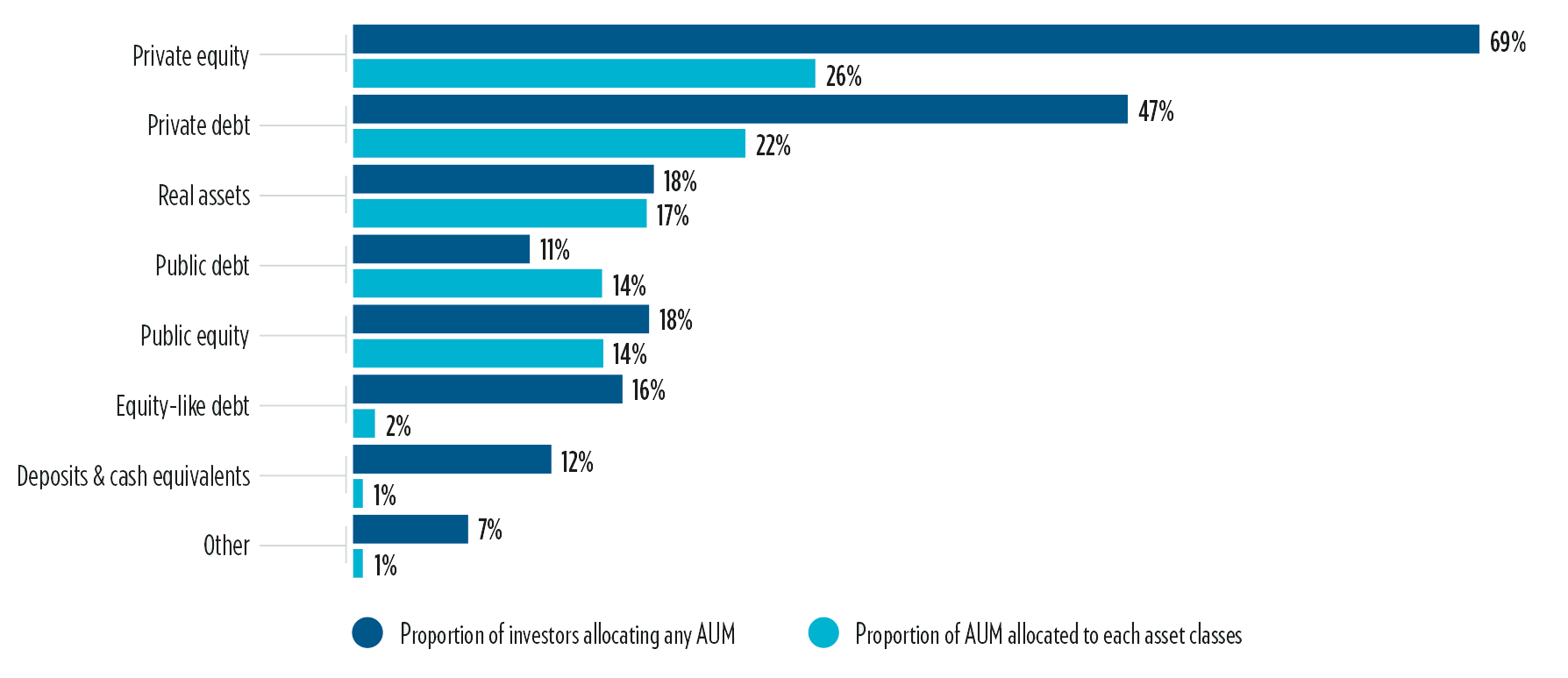

GIIN 2023 GIINsight: Impact Ixnvesting Allocations, Activity & Performance. Note: Excludes five outlier organizations based on AUM. ‘Other’ asset classes include social impact bonds, pay-for-performance instruments and guarantees.

PE/VC has long been the bedrock of the impact investing ecosystem. According to the Global Impact Investing Network’s 2023 report – 69% of investors active in the market are allocating to PE strategies, with 26% of AUM going to those strategies.

Source: Global Impact Investing Network (GIIN), 2023 GIINsight: Impact Investing Allocations, Activity & Performance

PE/VC is central to the impact economy and we want to build on that fantastic bedrock and secure its momentum.

This year, enabled by the support of the City of London Corporation, the Impact Investing Institute will be working to accelerate the growth of this part of the impact investing market.

Hand-in-glove with the PE/VC community and the brilliant organisations that support them, including the BVCA and Impact VC, we will be driving a dynamic series of events on PE/VC’s role in the just transition, in place-based impact investing, and in preventative health. We will also engage with LPs focused on family offices, endowments, Ultra-High-Net-Worth Individuals and pensions.

We want to take the lessons of these conversations to policy makers, asset allocators and the broader industry itself, to get them excited about driving and creating the future of investing.

The Excellence in Impact Awards will be a unique platform in this calendar of events to showcase your work to the world. More broadly for the sector, it will be an important moment to celebrate and amplify what PE/VC can do for society.

I look forward to reading your awards submissions and seeing you at our events. It is set to be a big year for London, private capital and impact. We would love for you to be a part of it.

Please contact [email protected] if you’d like to learn more about the Impact Investing Institute's PE/VC engagement programme this year.

Authored by Sarah Teacher

Executive Director of the Impact Investment Institute, and member of the BVCA Excellence in Impact 2024 Awards judging advisory panel