Pension and private capital industry leaders seek to help savers and unlock investment in venture capital and growth equity backed businesses

A panel of industry leaders from the world of pensions, venture capital and growth equity are working to overcome barriers to investment into private capital funds, with the objective of delivering higher returns for UK savers and a new source of capital to invest in high growth UK businesses.

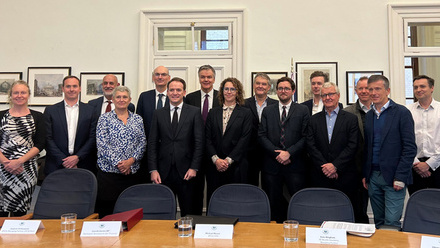

The Expert Panel, has been convened by the British Private Equity and Venture Capital Association (BVCA) and is chaired by Kerry Baldwin, Managing Partner of IQ Capital. It includes leading figures from across the pensions industry including the ABI, PLSA, Legal & General and NEST.

The UK pension market is worth over £2.5 trillion, making it the largest pension market in Europe. However, returns from UK pension funds are lower than international competitors. In part, this is because overseas pension funds invest in Venture Capital (VC) and Growth Equity (GE) at appropriate scale, and BVCA data shows that VC and GE investment have a track record of generating strong returns.

The Investment Compact for Venture Capital & Growth Equity Capital (the “Investment Compact”) is a commitment, signed by over 100 UK venture capital and growth equity fund managers, responsible for investments collectively valued at over £100bn, to develop a long-term and constructive working relationship with UK pension investors. It builds on the Mansion House Compact, in which some of the UK’s largest DC pension providers committed to allocate at least 5% of their default funds to ‘unlisted equities’.

The Expert Panel will consider the key structural and technical issues which must be addressed in order to unlock investment by the pensions industry into fast-growing private businesses through venture capital and growth equity funds. Areas to be explored by the panel will include technical challenges around liquidity, costs and pension platform compatibility.

It will also look at how industry can be supported in prioritising net returns for savers, consider ways of fostering broader understanding of the rationale for integrating private capital into savers’ portfolios, and assess how far the various investment structures currently used across the private capital and the pensions industries need to evolve.

The Expert Panel is expected to report in Autumn 2024, before final recommendations are provided to government, the pensions and private capital industries in the Spring.

Kerry Baldwin, Chair of the Pensions & Private Capital Expert Panel, said:

"I’m looking forward to working with colleagues in the pensions industry to understand how we can ensure UK savers can enjoy returns and investment diversification generated by backing promising homegrown businesses.

“We will thoroughly explore how pension funds in other countries have been able to invest in UK funds successfully, and get to the bottom of the technical and structural issues which hold back investment by UK pension funds in venture capital and growth equity backed firms.”

Chancellor of the Exchequer, Jeremy Hunt said:

“The launch of the BVCA’s Expert Panel shows there is real momentum behind our Mansion House reforms.

“Seeing industry leaders from our pension funds and growth investors come together to tackle the barriers to greater private investment is good for savers and good for business, and I look forward to seeing the results of the Panel’s work.”

Michael Moore, Chief Executive of the BVCA, said:

“For many years, the UK has grappled with the need to provide decent pensions and secure sustainable economic growth. Through the Mansion House reforms and our Investment Compact initiative, we’ve come closer in our search to find an appropriate shared solution.

“I am excited for our Expert Panel to take collaboration between the pensions and private capital industries further, so businesses get the capital they need to grow, which can in turn boost pension incomes for years to come."

Hannah Gurga, Director General of the ABI, said:

“The long-term savings industry is a major investor in the UK and across the world. We look forward to collaborating with the Expert Panel to help our industry play an even greater role in driving investment and economic growth.

“We expect there will be parallels to the lessons we’ve already learned through our Investment Delivery Forum - which helps accelerate investment into green and good infrastructure.”

Julian Mund, Chief Executive of the PLSA, said:

“UK pension funds have a vital role in supporting and providing retirement incomes, with workplace pension participation rates at 79%, and in recent years they have been gradually increasing their investments in growth areas of the UK economy.

“The PLSA and its members have been successfully working to highlight both remaining barriers – and solutions - to help broaden the adoption of these investment strategies, which have the potential to further boost those pension incomes. This initiative will bring together perspectives from both the demand and supply sides through the expert panel and identify practical steps that will enable greater allocations in venture and growth capital, aligning with the specific needs of scheme members.”

Notes to editors

- Members of the Pensions & Private Capital Expert Panel include: Kerry Baldwin, Managing Partner, IQ Capital (Chair); Rob Barr, Partner and Head of Investor Relations for the EMEA, Pantheon; John Chilman, Chief Executive, Railpen; Andy Gregory, Chief Executive Officer, BGF; Hannah Gurga, Director General, ABI; Tegs Harding, Professional Trustee and Head of Sustainability, IGG; Virginia Holmes, Independent Trustee / Chair of the Unilever UK Pension Fund; Neville Howe, General Counsel, NEST; Allan Marchington, Managing Director and Head of Life Sciences, ICG; Matthew McNally, Head of Strategic Change – Investment Office, M&G; Dan Mikulskis, Chief Investment Officer, People’s Partnership; James Mitchell, Head of Strategic Partnerships & Research, Phoenix Group; Michael Moore, Chief Executive, BVCA; Julian Mund, Chief Executive, PLSA; Camilla Richards, Partner and Head of Investor Relations, Atomico; Ruston Smith, Chairman of the Board of Directors, Smart Pension; Ben Wilkinson, Chief Financial Officer, Molten; Tom Wrenn, Managing Partner, ECI.

- The full Investment Compact document and signatories can be found here.

- Media contact: James Gribben, BVCA: [email protected]. M: 07854897974